Colorado’s Investor’s Real Estate Prospectus for 2020

XXXX Mortgage & Investments

Introduction:

We here at XXXX Mortgage & Investments would like to extend a hand of gratitude and appreciation to all of our clients past and present.

As we close out the decade and look to the start of a brand new one, we thought it might be a benefit to you, our clients, and members of the real estate community of Colorado, if we did our level best to provide you with an educated guess of what the coming year may bring to our lovely, Centennial State’s real estate market- as viewed through the lens of the investor.

What does the 2020 Colorado real estate market hold for investors?

As you know, we’ve all experienced some astronomical growth over the past decade. This wasn’t just enjoyed by the value of properties in most of Colorado’s markets but by new construction, tourism, and the growth of our civic population (and the challenges that has offered).

There are several differences between being a first-time home buying Millennial with a budding family and an individual, or coordinated group, looking to real estate as a vehicle for investment and wealth creation. Sure, some concerns are the same, but there’s usually a fundamental difference in approach. Many of those are outside the scope of this paper, but we here at XXXX do our best to work with investors and meet them where they’re at- at whatever level of size and/or experience.

It’s often said in the world of real estate investing, ‘The money is made when you buy, not when you sell.’ Now I’m sure you’ve heard that before, but it seems particularly poignant here. You see, the purchase price sets the tone for your profit in the future. Predicting an upside in either repairs/renovations, sweat equity, financing terms, positive thinking or market strides, aka ‘variables’ is perhaps not where you should hang the totality of your predicted ROIs.

What are some of the industry professionals and economists saying?

By scouring the internet, I’ve been able to compile a number of seemingly, objective and educated opinions as to where Colorado’s market might go in the coming year. Enjoy…

From the Colorado Real Estate Journal CREJ:

“In our interactions with the private capital market, we are seeing much higher levels of discipline in investment decisions and pursuit of deals that in many ways suggest the market is changing and some would say normalizing. There is no doubt that this expansion has been transformational for Colorado and specifically the Denver retail market, and it is also clear that Colorado will be a tremendous place for investors to place capital for retail investments long into the future.

So this rapid growth in valuation may be hitting a cooling trend- or ‘normalizing.’ There’s nothing wrong with that. If you or your clients are fix and flip investors, you might have a bit more of a challenge to reach your target upsides. However, the buy and hold specualtors are in it for a longer haul and might be more concerned with the rental market anyway.”

From the Home Buying Institute HBI:

(In reference to the steady gains Colorado’s market has enjoyed over the past decade-) “…that appears to be changing. In March of this year, the Denver Metro Association of REALTORS® (DMAR) reported that the median home price for the area had declined, year over year, for the first time since 2012.

That was the first sign that the Denver housing market might be nearing its peak for the current real estate cycle. There have been other indicators since then.

More recently, in May 2019, DMAR chair Heather Heuer said: “We are reaching our peak. There’s only so much farther we can go as far as home prices.””

Chart: Denver median home price over the past 10 years. Source: Zillow.com

From Norada Real Estate Investing NORADA: Denver Housing Market Forecast 2020 – 2021

“Here is a short and crisp Denver housing market forecast for the 3 years ending with the 3rd Quarter of 2021. The accuracy of this forecast for Denver is 76% and it is predicting a positive trend. LittleBigHomes.com estimates that the probability of rising home prices in Denver is 76% during this period. If this price forecast is correct, the Denver home values will be higher in the 3rd Quarter of 2021 than they were in the 3rd Quarter of 2018.”

So again, a predicted cooling in appreciation, but there’s still reason to look forward to gains, even if they’re not as strong. They might be making more houses (and condos), but they’re not making any more land…

Also from The Home Buying Institute HBI: Why a Slowdown Could Be a Good Thing

“If home prices in the Denver area do hit a plateau in 2020, it will likely be a short-term market ‘correction’ after which they will begin to climb again. But the annual gains we see in future years will probably be more modest in nature when compared to the bigger gains of the past few years.

From a broader economic standpoint, a cooling trend would probably be a good thing at this stage. Since the housing market recovery began in 2012 / 2013, home prices nationwide have risen at a rapid and unsustainable pace.”

From Agent Joe Mivshek- Keller Williams- Interview by MASHVISOR: “How does the Colorado housing market look like for 2020?”

Mivshek, “Interest rates are expected to stay steady through the year, and though prices of Colorado homes for sale have slowed some, no one sees a downturn since the unemployment rate is so low and Colorado is a very popular place to live. As a real estate investor, I would look for both short-term and long-term rental options. If an investment is priced high (such as mountain towns), look at the short-term/vacation rental market. If you find a home that can be rented long-term with a 6% or better cap rate, that is the way to go. You will get long-term appreciation for both.”

See there you go, buy and hold. And as Joe has suggested, you might even do better in the vacation market, as opposed to the steady renter. I could see that, especially in mountain areas (as he suggested), as the need for professional positions is much more scant than in the urbanized areas.

What are some of the market indicators we can pull from to form an educated prospectus?

From Financial Samurai:

“Although inventory is still historically low, it’s important to realize the inflection point we’ve experienced in mid-2018. In just several months, the amount of inventory is back to where it was at the end of 2012. If the trend continues, we could quickly get back to 2008-2010 levels.

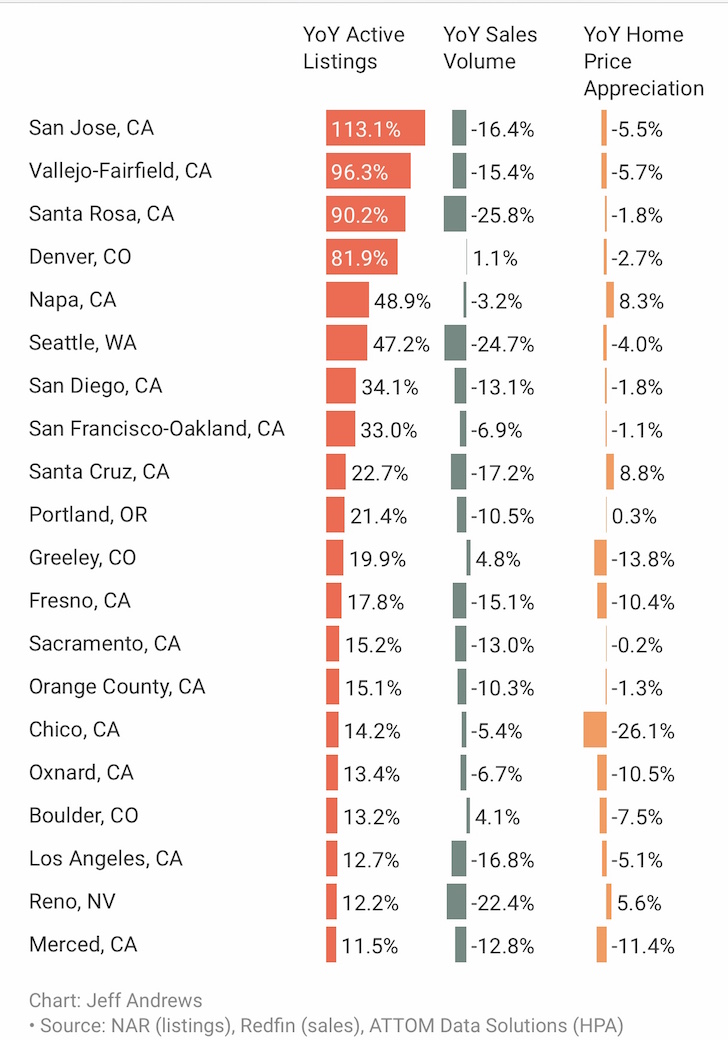

Here’s a more detailed inventory job of specific cities in 4Q2018. It is too late to sell in places like San Jose, Vallejo-Fairfield, Santa Rosa, Denver, Napa, Seattle, San Diego, San Francisco, and Oakland for maximum dollars. But giving downturns generally last 2-5 years, pricing is likely going to get worse.”

Again from NORADA:

Denver Home Prices And Real Estate Appreciation

“Over the last 20 years, Denver has proven that it will generate equity quickly regardless of almost any purchase price. The first reason is that there is little real estate to be had in downtown and the surrounding area.

As such, the home prices in Denver rarely fall, almost always growing in value. According to the stats from Neigborhoodscout.com, the Denver real estate appreciated 103.25% over the last ten years, which is an average annual home appreciation rate of 7.35%, putting Denver in the top 10% nationally for real estate appreciation.

Real Estate appreciation rates are so strong in Denver that despite a nationwide downturn in the housing market, Denver real estate has continued to appreciate in value faster than most communities.

In the latest twelve months, Denver real estate appreciation rates continue to be some of the highest in America, at 10.12%, which is higher than appreciation rates in 93.37% of the cities and towns in the nation.”

I have a hard time agreeing with; “…will generate equity quickly regardless of almost any purchase price.” But okay. Again, opinions…

You may find the following interesting from Zillow.com

From Zillow.com:

SEATTLE, May 22, 2018 /PRNewswire/ – The United States will likely enter the next recession in 2020, according to the 2018 Q2 Zillow® Home Price Expectations Survey.

“The quarterly survey, sponsored by Zillow and conducted by Pulsenomics LLC, asked more than 100 real estate experts and economists about their predictions for the housing market, including when the next recession would begin and what could trigger it.

Overall, nearly half of all the experts surveyed expect the next recession to begin sometime in 2020, with Q1 being the most commonly selected quarter. More than half of the survey respondents pointed to monetary policy as the likeliest cause.

The current economic expansion is the second longest in American history, and will be the longest ever recorded if the panelists’ predictions hold true. The housing market collapse led to the Great Recession, but few experts – just nine of the respondents – think the housing market will be at the center of the next downturn.”

From The Denver Metro:

““When homeowners stay put, that can reduce the number of homes for sale, making a market more competitive for buyers,” said Daryl Fairweather, chief economist with Redfin, in the study.

That raises the question of how much tighter metro Denver’s housing market might have been if so many owners here hadn’t put up a for-sale sign.

Even with tenure barely budging, there are only half as many homes available for sale in metro Denver this year compared to 2010. And the median price of a home sold has doubled this decade.

Metro Denver homes prices didn’t fall to the degree they did in places like Miami, Phoenix and Las Vegas during the housing downturn. And they rebounded faster, meaning owners weren’t trapped as long owing more on the mortgage than they could get in a sale.”

To me that suggests that Denver’s market, and Colorado’s as a whole, may be more stable, in general, than much of the metro areas of most of the country. Also, besides the low unemployment rate, there are so many other factors Colorado enjoys, that that idea- of a greater stability- is not at all hard to fathom.

How does boom, or bust economies affect R.E. Investors?

From Investopedia:

Once you’ve established that an above-average rise in housing prices is primarily driven by an increase in demand, you may ask what the causes of that increase in demand are. There are several possibilities:

- An upturn in general economic activity and prosperity that puts more disposable income in consumers’ pockets and encourages home ownership.

- An increase in the population or the demographic segment of the population entering the housing market.

- A low, general level of interest rates, particularly short-term interest rates, that makes homes more affordable.

- Innovative mortgage products with low initial monthly payments that make homes more affordable. (To learn more about mortgages, see our Mortgage Basics tutorial.)

- Easy access to credit—a lowering of underwriting standards—that brings more buyers to market.

- High-yielding structured mortgage bonds, as demanded by investors, that make more mortgage credit available to borrowers.

- A potential mispricing of risk by mortgage lenders and mortgage bond investors that expands the availability of credit to borrowers.

- The short-term relationship between a mortgage broker and a borrower under which borrowers are sometime encouraged to take excessive risks.

- A lack of financial literacy and excessive risk-taking by mortgage borrowers.

- Speculative and risky behavior by home buyers and property investors fueled by unrealistic and unsustainable home price appreciation estimates.

That’s interesting… When I suggested that Colorado has much to offer (as a State), that might lend to the stability of the market, by steady demand, it had nothing to do with the above list generated by Investopedia. Honestly, I was thinking more in the way of the natural wonders, aspects of health, lifestyle, livability, and reputation of the people.

How do real estate investor concerns and objectives differ from first-time home buyers?

It’s hard for me to imagine myself as a first-time home buyer. I’ve had a deep interest in real estate from a very early age and was working full-time bundling appraisals back when computer screens only had one color. But a little knowledge CAN be dangerous (as I’ve adeptly proven to myself)… But if I were a first-timer, and I had a wife, and we were both doing well and felt we were stable enough to take the plunge… I’d educate myself and find a serious fixer.

Seasoned investors (and I would call myself lightly seasoned), handle things differently. The good ones are completely dispassionate.

Newbies aren’t, not usually, especially after they’ve envisioned the exact shade of green they’d paint the kitchen. And really, when a market is hot, they may not have the knowledge, backbone, or cold cash to play in a market that they could easily be out-classed in.

How about a condo kids?

From the Real Wealth Network:

You might find the following interesting. And had it been up to me, my first home would have been a gutted four-plex in downtown Sacramento- had my parents co-signed. Frankly, I (we) would have done very well on that property.

But looking back at my 22year old self, I’m not sure I would have co-signed either.

Reason #1: Home Values are at an All-Time High

“The first reason to consider buying an investment property before your first home is because home values are at an all-time high. To be precise, home values across the United States have risen 7.6% in the last year, with an additional 6.4% increase expected within the next year. The average home value, in the U.S., is currently $220,100. The average listing price to buy a home is $275,000. The median rent in 2018 is now $1,650.

According to the National Association of Realtors (NAR), existing single-family home values have increased 90% in most metro areas. The cause for this dramatic increase is the extremely low inventory of houses for sale, leading to higher home values than ever before.

While home sales slowed a bit in the second quarter of 2018, the appreciation of homes continued to rise. Because the demand for homes is so high and supply so low, sellers are receiving multiple offers well above market value, thus contributing to the increase in home appreciation.”

From what I’ve read, sellers aren’t receiving as many multiple offers as they were just recently. ‘Normalization’, certainly doesn’t mean a lack of healthy appreciation, or stagnation, by any means.

From Realtor.com:

“The National Association of Realtors® released the 2016 Investment and Vacation Home Buyers Report last week, providing insight into consumer-driven home purchases. The report, which has been conducted annually since 2003, is based on a survey of U.S. consumers who purchased a residential property in 2015—whether it’s their primary residence, an investment home, or a vacation home.

Not surprisingly, investor buyers have substantially higher incomes than both median-income households and primary residence buyers: The typical buyer of an investment home in 2015 had a median household income of $95,800. So part of the secret of their success is simple: They have the cash and credit to make it happen. Investment home buyers are less likely to finance their purchase with a mortgage. Furthermore, when they do, the vast majority put down more than 20%.

In fact, the average investor mortgage had a down payment of 26% compared with an average of 11% for an owner-occupier, according to our analysis of 2015 purchase mortgage activity from Optimal Blue (an enterprise lending software company whose platform handles more than 25% of mortgages in the U.S.). Likewise, an investor has a qualification advantage of a lower debt-to-income ratio as well as much higher credit scores.”

Kids today might do well to find a property owned by a friend of a friend, at least something off-market, and then call in they’re other friend (an Agent) to close the deal.

So what are your plans for 2020 when it comes to R.E. Investing?

When you take all of the educated speculations and historical perspective, what are your real estate investing plans for 2020? And, if anything, what are you going to tell your clients?

I think ultimately, it depends on what your, or your clients’ goals are.

As investors, we can look at a property, its numbers, and its potential and fully realize we might be ‘buying high,’ but it still makes sense for one reason or another and it fits well in what we’re trying to do, or the portfolio we’re trying to build.

Now should this be a bubble we’re facing in the first quarter of 2020 (that I highly doubt), and your client is planning on a quick fix and flip in the first quarter, he may be caught with his pants down when he’s ready to sell- depending on his definition of quick.

Then if you take the same property and give it a fresh coat of paint, actually mow the lawn, cut the tree branches off the roof, and get some renters in there (in a strong market), your client may do just fine riding out what we all know is just another cycle.

As I mentioned above, ‘Land, they’re not making any more of it.’

In closing…

Real estate investing is an interesting game. I call it a game, but it’s just as much an art, as it is a flexible science, as it is certainly is a profession. And I know I’m not speaking only for myself when I say, ‘It gets in your blood.’

I’ve personally found, bought, renovated, and sold two properties in a ‘bad’ market- 2009 in Portland, OR to be specific, and I did well on both. I’ve also completely lost my butt after sinking a bunch of cash into a lease option I didn’t have the right to assign in Northern CA.

That is what qualifies me as a ‘lightly seasoned investor’, losing hard.

I wouldn’t wish that experience on my worst enemy, but the experience didn’t care. And really, was it anyone’s fault, other than mine? Nope.

Due diligence my friends, due diligence.

References and disclaimer.

http://www.homebuyinginstitute.com/news/forecast-denver-starting-to-level/

http://www.noradarealestate.com/blog/denver-real-estate-market/

http://www.homebuyinginstitute.com/news/denver-market-wont-crash-in-2020/

http://zillow.mediaroom.com/2018-05-22-Experts-Predict-Next-Recession-Will-Begin-in-2020

https://www.realwealthnetwork.com/learn/buying-an-investment-property-before-first-home/

Disclaimer: This article contains home-price forecasts and projections issued by third parties not associated with the Home Buying Institute. Such predictions are the equivalent of an educated guess and should be treated as such.